China Defiant As Trump Rattles Asia’s Energy Markets

India, S.Korea, Taiwan, Japan will raise U.S. oil and gas imports

Ng Weng Hoong, June 10, 2025, Tuesday

NOTE: This article first appeared in the May 2025 issue of HYDROCARBON magazine. Submitted on March 11, 2025. 2,135 words

Donald Trump would have been a formidable oil trader.

Instead, he chose politics, became the President of the U.S. (twice), and is now shaking up the energy markets on his way to creating a new world order.

At the start of his second term on January 20, 2025, Trump announced the launch of a national energy emergency programme to boost domestic oil and gas production, raise the country’s strategic oil stockpile, and end the United States’s participation in the 2015 Paris climate agreement.

Asian allies pressured to buy more U.S. oil

To appease Trump’s anger over their ‘unfair’ trade practices, three of Asia’s four largest energy consumers immediately committed to import more oil and gas from the United States. This will impact global trade flows as India, South Korea, and Japan, which collectively account for 30% of Asia’s oil consumption, will likely reduce purchases from their traditional suppliers in the Middle East and Russia.

The trio, together with Taiwan, imported a combined record 946,000 barrels/day of crude oil from the U.S. in 2024. They share the same motivations to step up the purchase of U.S. fossil fuels over the course of Trump’s second term which ends in 2029.

Firstly, as energy-deficient countries, they are heavily reliant on imports that the U.S. is well positioned to supply. Secondly, the increased imports will help reduce their respective trade surpluses against the U.S. Lastly, they want a role in building up America’s energy sector in the hope of winning Trump’s expanded commitment to Asia to counter China’s growing influence in the region.

The Trump-Modi oil bond

India has become a key geopolitical and economic partner of the U.S. over the past decade. The personal bond developed between Prime Minister Narendra Modi and Trump has carried over from the president’s first term in 2017 to 2021.

Oil has emerged as a surprising platform in the two countries’ growing bilateral ties, with the US sending crude to India, and refined products going the other direction and to western Europe. India’s rising energy demand has coincided with the U.S.’s emergence as a major oil producer, thanks to its shale-based revolution.

By the time Joe Biden became the 46th president in January 2021, oil and gas was already “the cornerstone of bilateral trade” between the two countries, accounting for 15% of their merchandise trade, according to analyst Hari Seshasayee (1) writing for the Wilson Centre.

US crude exports to India hit a record of more than 420/000 b/d in 2021, up nearly 49% from the previous year, according to the U.S. Energy Information Administration (EIA). (2)

That growth was impressive against the backdrop of the world economy plunging into recession during the COVID-19 pandemic.

But 2021’s volume turned out to be the peak as India’s appetite for US crude fell sharply the following two years when Russia, overnight, became a competing supplier.

By offering huge discounts for its commodities, Russia’s export of crude to India surged to a record of 800,000 b/d in 2022, up from just 84,000 b/d (3) the previous year.

Russia was forced into a fire sale when it was hit by global trade sanctions organised by the U.S. in response to President Vladimir Putin’s military invasion of Ukraine on February 24, 2022.

India ignored the sanctions to gorge on cheap Russian oil just as the Brent crude price rocketed past US$100 a barrel in the early months of the war.

“A study by the Indian rating agency ICRA estimated that India saved around US$5.1 billion on oil imports in 2023 and US$7.9 billion in the first eleven months of 2024, for a total of US$13 billion,” according to the National Bureau of Asian Research.

Partly to placate the anger of American politicians, India then raised its import of crude from the U.S. For the first 11 months of 2024, India’s intake of U.S. crude rose by 29.4% to more than 217,000 b/d.

It is expected to rise further as India is now the fastest growing oil consumer among the world’s major economies.

The EIA expects India to account for 25% of the world’s oil consumption growth in 2024 and 2025.

“Driven by rising demand for transportation fuels and fuels for home cooking, consumption of liquid fuels in India is forecast to increase by 220,000 b/d in 2024 and by 330,000 b/d in 2025. That growth is the most of any country in our forecast in each of the years,” said the EIA.

In their first meeting since Trump’s re-election, Modi indicated that his government would endeavour to reduce India’s US$45.7 billion trade surplus with the world’s largest economy by boosting its import of oil and gas, and defence equipment from the US.

South Korea, Japan, and Taiwan fall in line

Like India, East Asia’s three democracies are also looking to win Trump’s favour by strengthening ties with the U.S. oil and gas industry.

South Korea, already among the world’s most important markets for U.S. crude oil, imported a record 484,400 b/d in the first 11 months of 2024, up nearly 80% from 2020.

In an interview with the Yonhap news agency, South Korean Industry Minister Ahn Duk-geun (4) pledged to further raise his country’s import of U.S. fossil fuels to directly address Trump’s complaint about their bilateral trade imbalance. South Korea reported a record US$55.7 billion surplus in its merchandise trade with the U.S. in 2024.

Among Asian countries, Taiwan is under the greatest pressure to win over the Trump administration due to its overwhelming reliance on U.S. protection against China’s threats to ‘reclaim’ the island. Taiwan has committed to increase energy imports and defence spending to pare down its trade surplus against the U.S. which rose more than 3.5 times from US$18 billion in 2020 to nearly US$65 billion in 2024.

The U.S. now accounts for nearly a quarter of Taiwanese oil imports. Due to its limited refining capacity, Taiwan is unlikely to substantially improve on its recent intake of 217,300 b/d of U.S. crude. Instead, it will look to boost its purchase of liquefied natural gas (LNG) from Alaska.

Japan will follow in the footsteps of South Korea and Taiwan in raising LNG imports from the U.S. However, Japanese imports of U.S. crude will remain insignificant owing to its declining appetite for oil.

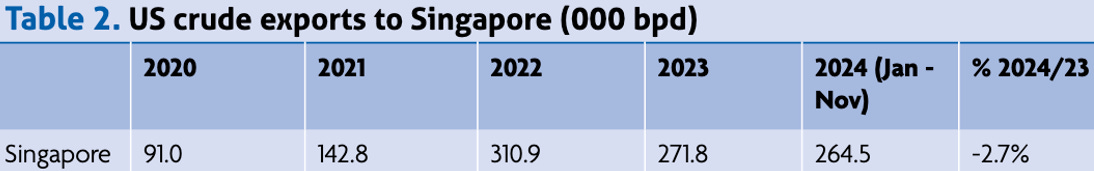

Singapore is spared, for now

The U.S. has become one of Singapore’s largest crude suppliers this decade, with sales rising to a record of nearly 311,000 b/d in 2022. Those volumes have declined over the past two years, likely the result of competition from cheaper crude to markets taken over by discounted Russian supplies.

Singapore is under far less pressure than the other major Asian economies to increase U.S. crude imports for three reasons.

Rare among Asian countries, the city state has been running a consistent trade deficit with the U.S. It was up by more than 80% from US$1.3 billion in 2023 to US$2.4 billion in 2024. Uniquely too, Singapore is friendly with China while enjoying strong political, economic, intelligence, and military ties with the U.S. at the same time. Lastly, the U.S. already has a major role in Singapore’s oil trading, financing, distribution, and price-making functions through companies such as ExxonMobil, Citibank, JP Morgan, and S&P Global.

As a result, Singapore has not been called out by Trump to undertake any major ‘corrective’ actions. But that does not mean it is off his radar as Singapore is an increasingly vital base for Chinese trade, investment, and financing activities.

In 2009, state-owned PetroChina acquired Singapore Petroleum Co., giving Beijing a frontline role in Asia’s leading oil refining, storage, distribution, and trading centre. Given the extensive Chinese and American involvement in its society and economy, Singapore is an inevitable battleground in any war scenario involving the U.S. and China.

Furthermore, the island’s world-class 1.4 million b/d of refining capacity, oil storage tanks, and refuelling infrastructure for ships and fighter planes will be prized military assets in the event of a shooting war in the Asia Pacific region.

Oil in U.S.-China politics

China is a fairly significant buyer of U.S. oil and gas, but the trade has entered a turbulent and uncertain phase, reflecting the growing tensions in their bilateral ties.

Unlike other Asian countries, China is strong enough to rebuff the Trump administration’s attempts to sway its energy policy and trade. Despite chalking up a massive US$295 billion trade surplus against the U.S. in 2024, up 5.8% from 2023, China feels no obligation to buy more fossil fuels from the U.S. to reduce the imbalance.

Indeed, China’s import of U.S. crude and refined products fell 14% in 2024 after peaking at nearly 993,000 b/d in 2023.

While economics played a part in the decline, geopolitical considerations has also influenced China’s decision to reduce dependence on U.S. energy supplies. Beijing underlined that point by (brazenly) imposing tariffs on U.S. oil and gas imports from February 2025.

For now, China can still look to Russia, which remains under Western economic sanctions, for much of its energy supplies. According to the EIA, China’s crude imports from Russia have risen for three consecutive years to reach a record 2.2 million b/d in 2024, up about 1% from 2023.

But Trump’s recent decision to engage with Putin over the Ukraine war may have been partly intended to disrupt Russia’s close ties with China. It could set the stage for sanctions to be eventually loosened so as to reduce Russia’s heavy reliance on selling its oil and gas to China and India. Already struggling with slow growth and a huge debt overload, the Chinese economy would suffer if it loses access to discounted Russian oil and gas supplies.

In February 2025, the U.S. Treasury Department imposed tough sanctions on several companies, individuals, and tankers that deliver Iranian oil to China.

“The oil was shipped on behalf of Iran’s Armed Forces General Staff (AFGS) and its sanctioned front company, Sepehr Energy Jahan Nama Pars,” said a Treasury Department statement (5).

“Iran generates the equivalent of billions of dollars each year via oil sales to fund its destabilising regional activities and support of multiple regional terrorist groups, including Hamas, the Houthis, and Hizballah. The AFGS utilises networks of foreign-based front companies and brokers to enable these oil sales and shipments.”

Iran exported between one million b/d and 1.5 million b/d of crude to China over the course of this decade, according to the Congressional Research Service (CRS) (6) which provides analysis to the U.S. House of Congress. In 2024, Iran sold a record US$70 billion worth of crude oil and petrochemical products to China, said the CRS, citing The Economist magazine.

Apart from fulfilling Trump’s avowed goal to deprive Iran of much-needed oil revenue, the sanctions could have the added impact of dampening Beijing’s increasing political and commercial ties with Tehran.

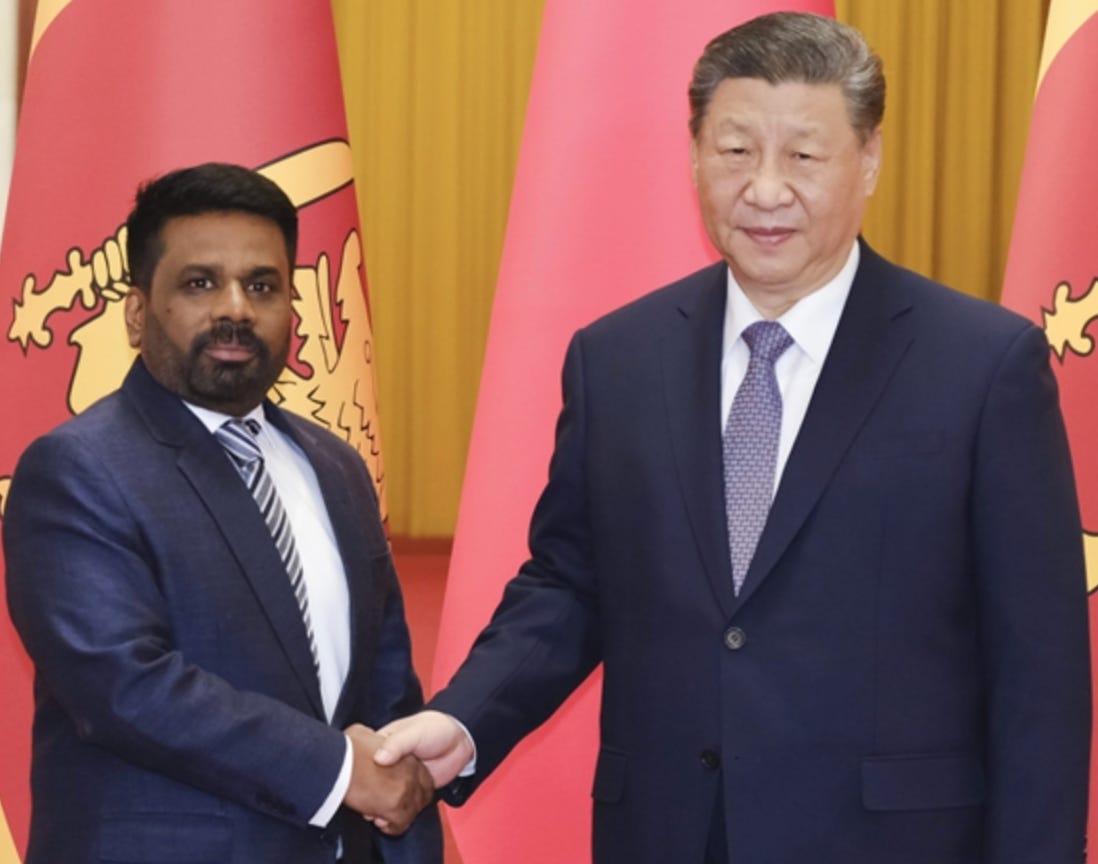

China targets Indian Ocean with Sri Lanka investments

The Indian Ocean is emerging as another area of contest pitting China against the U.S. and India.

China may have secured a vital platform to grow its presence in the Indian Ocean after agreeing with the Sri Lankan government to fast-track the construction of a US$3.7 billion oil refinery. The 200,000 b/d refinery will be Sri Lanka’s single largest stand-alone investment if it is completed on schedule by 2027.

The proposed project near the island’s southeastern port of Hambantota had been delayed by domestic political turmoil and financial problems following the collapse of the Rajapaksa government in 2022.

Two months after his party was elected to power in November 2024, Sri Lanka’s new President, Anura Kumara Dissanayake, flew to Beijing to meet China’s President Xi Jinping to strengthen political and economic ties.

Dissanayake returned home with a slew of agreements, including the coveted refinery deal that will be key to the country’s economic recovery.

Chinese state firm Sinopec will build and likely operate the refinery to add to its growing portfolio in the South Asian nation. The company is already the owner of an oil storage terminal and the operator of a crucial bunker fuel business in Hambantota’s strategic port that serve the shipping traffic in the Indian Ocean.

For Sri Lanka, the refinery will enhance the nation’s energy security as well as generate much-needed export earnings for its cash-strapped economy.

FOOTNOTES

1. https://www.wilsoncenter.org/blog-post/oil-new-chapter-us-india-relations

Hari Seshasayee, Wilson Center, February 10, 2022. Oil: A new chapter in U.S.-India relations2. https://www.eia.gov/todayinenergy/detail.php?id=64084

U.S. Energy Information Administration, 2024. India to surpass China as the top source of global oil consumption growth in 2024 and 2025.

3. https://www.nbr.org/publication/oil-for-india

Raymond E. Vickery, and Tom Cutler, The National Bureau of Asian Research, September 3, 2024. Oil for India4. https://en.yna.co.kr/view/AEN20241129010100320

Kang Yoong-Seung, Yonhap News Agency, December 7, 2024. South Korea aims to expand imports from U.S. ‘constructively’ to address Trump uncertainties: minister.5. https://home.treasury.gov/news/press-releases/sb0015

U.S. Treasury Department, February 6, 2025. Treasury targets oil network generating hundreds of millions of dollars for Iran’s military6. https://www.congress.gov/crs-product/IN12267

Congressional Research Service (Library of Congress). 2024. Iran’s petroleum exports to China and U.S. sanctions.PHOTOS

https://www.whitehouse.gov/gallery/president-donald-trump-meets-with-prime-minister-narendra-modi-of-india White House, February 13, 2025. President Donald Trump hosts a bilateral meeting with Prime Minister Narendra Modi of India in the East Room.

www.youtube.com/watch?v=IKEnar99uLM&ab_channel=ArirangNews

Arirang News, March 4, 2025. South Korea’s Trade Minister Ahn Duk-geun with U.S. Commerce Secretary Howard Lutnick in Washington DC on February 28, 2025

https://english.www.gov.cn/news/202501/15/content_WS6787bb99c6d0868f4e8eed7f.html

State Council of the PRC via Xinhua, January 15, 2025. China’s President Xi Jinping hosts Sri Lanka’s President Anura Kumara Dissanayake at the Great Hall of the People in Beijing